From Experiment to Enterprise: AI’s Accelerated Journey in Finance

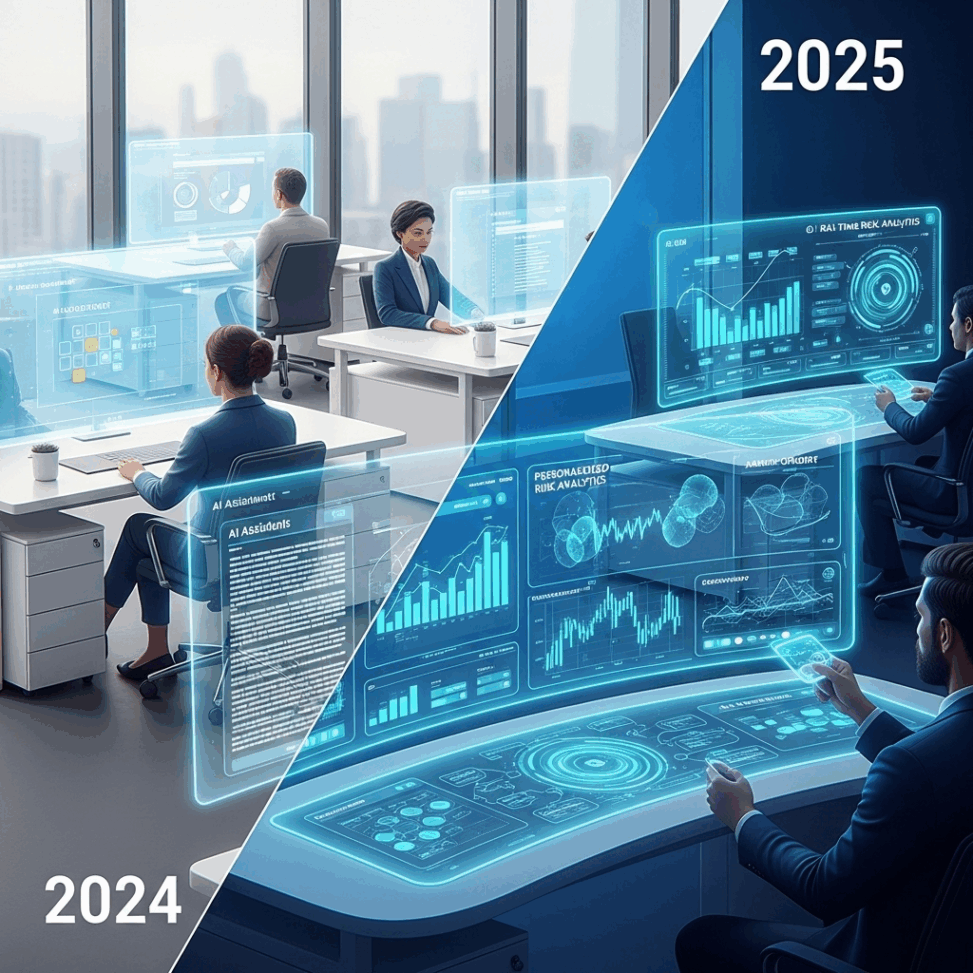

The world of artificial intelligence is evolving at an unprecedented pace, and nowhere is this transformation more evident than within the financial sector. What began as cautious experimentation in 2024 rapidly escalated into strategic, enterprise-wide integration by 2025, fundamentally reshaping how financial institutions operate.

This swift transition marks a pivotal moment, moving AI from a niche tool to a foundational pillar of modern finance. Let’s explore this remarkable evolution.

2024: The Year of AI Exploration and Narrow Automation

In 2024, financial institutions primarily approached AI with a focus on optimizing existing tasks and exploring initial proofs-of-concept (PoCs). The applications were valuable but often limited in scope:

- Automated Report Drafting: AI models assisted in generating standard financial reports, significantly reducing manual effort and accelerating reporting cycles.

- Research Summarization: Large Language Models (LLMs) were deployed to distill vast amounts of market research, news, and regulatory documents into concise, digestible summaries for analysts and decision-makers.

- Proof-of-Concept Copilots: Early versions of AI-powered copilots began to assist employees with specific, repetitive tasks. These ranged from answering basic customer service inquiries to helping with internal data queries and compliance checks.

While these implementations demonstrated AI’s potential for efficiency, they were largely siloed applications, serving as a prelude to deeper, more integrated capabilities.

2025: Strategic AI Integration Takes Center Stage

Fast forward to 2025, and the landscape shifted dramatically. AI moved beyond the experimental bench and became deeply embedded into the core operational fabric of financial institutions. The focus evolved from mere automation to strategic enhancement and intelligent decision-making across the enterprise.

Key Advancements and Applications in 2025:

- Enhanced Customer Experience: AI-driven personalization became mainstream. From tailored investment advice and proactive fraud alerts to highly responsive virtual assistants, AI redefined client engagement by offering more relevant and timely interactions.

- Sophisticated Risk Management: AI models, powered by advanced machine learning, provided real-time risk assessment, predictive analytics for market fluctuations, and more accurate credit scoring. This shifted from simple anomaly detection to proactive risk mitigation strategies.

- Optimized Operations Across Departments: Copilots matured significantly, integrating seamlessly into workflows across various departments—from compliance and legal to trading and back-office operations. They functioned as intelligent assistants, augmenting human capabilities rather than merely automating tasks.

- Advanced Fraud Detection & Cybersecurity: AI’s ability to identify complex patterns and anomalies in vast datasets made it an indispensable tool in combating increasingly sophisticated financial fraud and cyber threats, offering a crucial layer of security.

- Data-Driven Strategic Insights: AI transformed raw data into actionable intelligence at an unprecedented scale, enabling institutions to identify new market opportunities, optimize product offerings, and improve long-term strategic planning.

Driving Forces Behind the Rapid Shift

Several factors accelerated this rapid transition from experimentation to full-scale integration:

- Maturity of AI Models: Significant advancements in LLMs, generative AI, and other AI architectures made them more capable, reliable, and easier to implement.

- Improved Data Infrastructure: Enhanced data pipelines, robust cloud infrastructure, and better data governance provided the necessary backbone for scaling sophisticated AI applications.

- Competitive Imperative: Early adopters demonstrated clear advantages in efficiency, customer satisfaction, and risk mitigation, pressuring competitors to accelerate their own AI strategies.

- Growing Talent Pool: A burgeoning ecosystem of AI professionals and increased internal training efforts helped financial institutions bridge the skill gap required for advanced AI deployment.

Challenges and the Path Forward

This rapid evolution wasn’t without its hurdles. Financial institutions continued to grapple with critical considerations:

- Data Governance and Privacy: Ensuring ethical data use and strict compliance with stringent global regulations like GDPR and CCPA remained paramount.

- AI Ethics and Bias: Developing fair, transparent, and unbiased AI systems, especially in sensitive areas like credit lending and risk assessment, was a continuous challenge.

- Regulatory Scrutiny: Navigating an evolving regulatory landscape as authorities work to understand and govern AI’s impact became increasingly complex.

- Workforce Transformation: Upskilling and reskilling the existing workforce to effectively collaborate with and manage AI systems was crucial for successful adoption.

The Future is Now

The journey from 2024’s cautious AI experiments to 2025’s strategic enterprise-wide integration marks a pivotal and irreversible moment for financial institutions. AI is no longer a futuristic concept but a fundamental pillar of modern finance, driving unparalleled efficiency, enhancing customer experiences, and fortifying decision-making processes.

As we look beyond 2025, the synergy between human intelligence and artificial intelligence promises to unlock even greater potential, ushering in an era of innovation that will continue to reshape the financial world in profound and exciting ways.

Leave a Reply